After three decades of decentralization, Philippine local government units (LGUs) still face challenges in delivering basic services devolved to them with the passing of the Local Government Code of 1991. Despite of the enactment of the code, the national government continues to deliver services assigned to the LGUs.

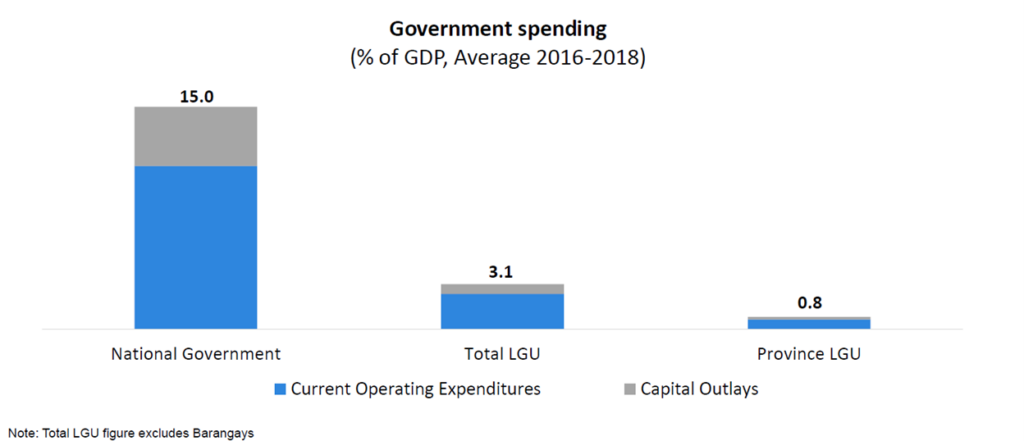

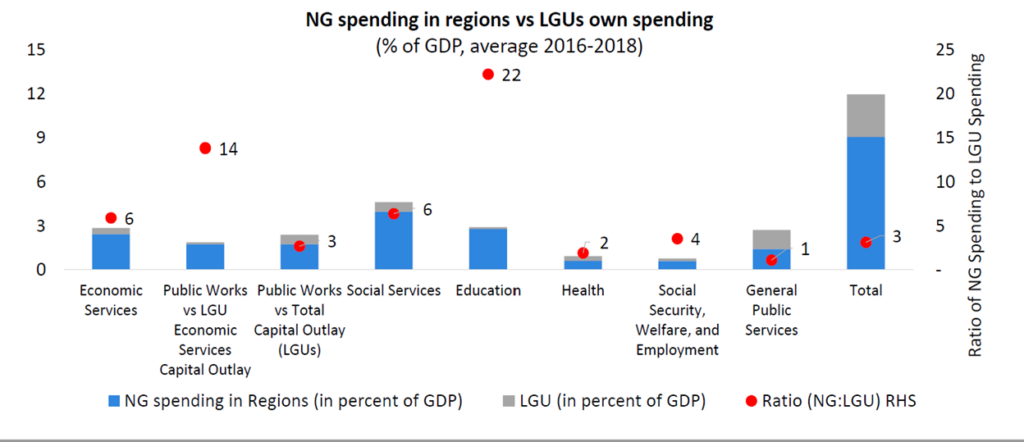

National government spends significant amount of budgetary resources on behalf of LGUs, especially in education and public works.

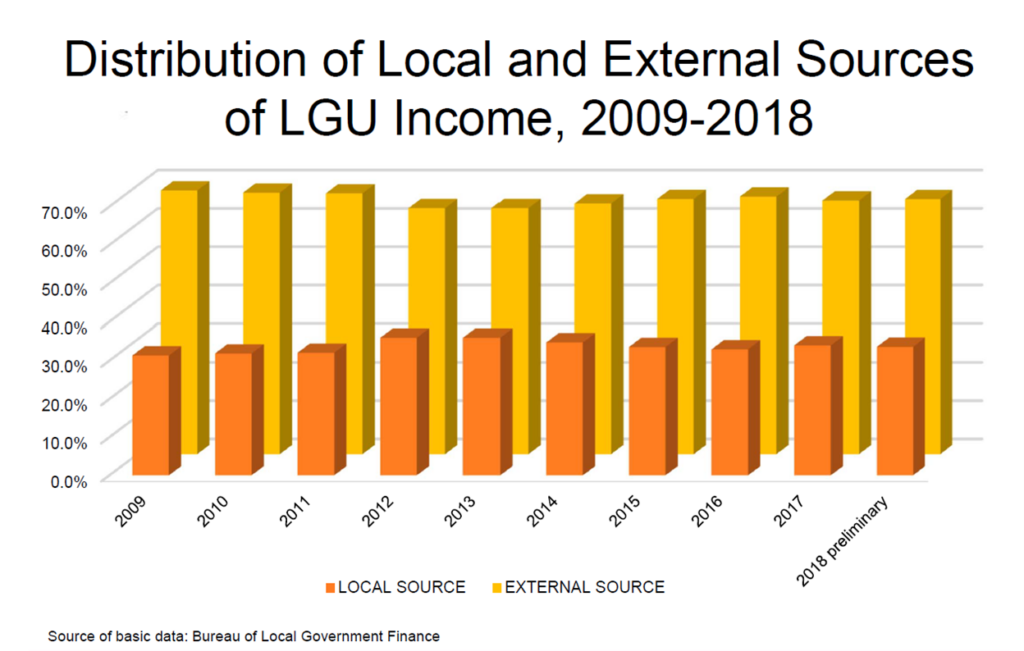

In the meantime, LGUs continue to have low revenue effort with own source revenues averaging about 30 % of their total revenues. LGUs depend primarily on external sources for revenue, especially on intergovernmental fiscal transfers (also known as Internal Revenue Allotment—IRA).

In April 2019, the Supreme Court of the Philippines ruled on the petitions filed by Mandanas et al. (G.R. No. 199802) and Garcia (G.R. No. 208488) regarding the computation of the LGUs’ share in national internal revenue taxes (NIRTs) as mandated under Section 284 of the 1991 Local Government Code. This ruling, which will come into effect in FY22, increases the total IRA amount by PhP 225.3 billion (around 0.9 % of GDP).

With this increase, the national government faces fiscal space constraints as the economy is still reeling from the effects of the COVID-19 pandemic. The substantial increase in IRA has prompted the national government to rethink its approach towards decentralization, which remains below its potential for effective service delivery.

The recent World Bank Philippines Economic Update (PEU) suggests that the authorities need to prudently manage the implementation of the Mandanas Ruling in 2022.According to the World Bank, effective service delivery has been constrained by four structural challenges that have negatively affected the incentives and capacity of local governments to fulfill their primary role as basic service providers:

- First, LGUs collect insufficient revenues and this contributes to a mismatch given service delivery responsibilities.

- Second, the intergovernmental fiscal transfer system creates horizontal fiscal imbalances and inequality across local governments.

- Third, overlapping service delivery responsibilities across different levels of government diffuse accountability.

- Fourth, LGUs continue to depend on national government for the delivery of devolved public services due to the lack of technical capacity.

The national government plans to transfer devolved functions currently assumed by the national government back to local government units equivalent to 1 percent of GDP during the implementation of the ruling. However, coordination challenges between the national government and LGUs could jeopardize the quality and quantity of service delivery.

According to the World Bank PEU, overcoming the structural challenges while managing the transition towards increased decentralization require the following: (i) addressing horizontal inequity through strong fiscal equalization; (ii) providing capacity building support to LGUs; and (iii) creating an environment of increased demand for transparency and accountability.

In the short-term, addressing the implementation challenges due to the Mandanas Ruling requires immediate clarification on the re-devolved functions, and communicating these clearly to national government agencies and LGUs. In the medium-term, the national government must provide strong fiscal equalization by continuing to support LGUs that lack capacity and resources. The national government and implementing agencies could strengthen local government capacity on providing an enabling environment for LGUs that assigns responsibilities according to available capacity and ensures a highly participatory process involving learning by doing. In the long-term, revisiting the 1991 Local Government Code is needed to address systemic issues on own-source revenue generation, address the horizontal fiscal imbalances created by the current IRA formula, and clear assignment of service delivery responsibilities.

You can read the full report on the World Bank’s website: Philippines Economic Update June 2021 Edition: Navigating a Challenging Recovery