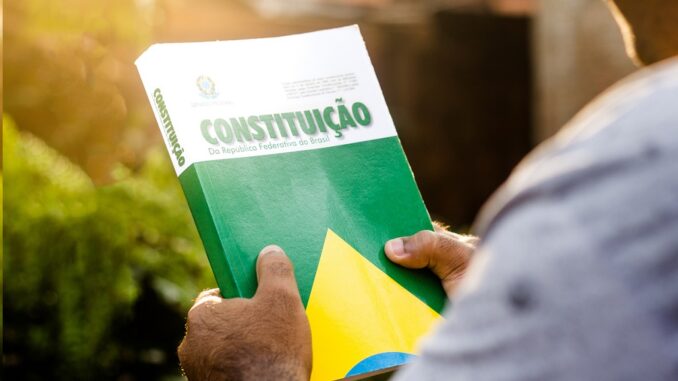

Brazil is a three-tiered federation since the Federal Constitution of 1988 decentralized the political power and strengthened federalism, turning the municipalities into a member of the federation with administrative and political autonomy. The federal pact is based on the distribution of power and assignments among the levels of government established by the Constitution.

Due to this division, Brazil is characterized by a relatively high degree of political and fiscal decentralization compared to other countries. On the other hand, there are competition and overlap in the division of some attributions, such as the provision of health and education services.

Tax assignment in Brazil is clearly defined in the Constitution. Brazil is considered a fiscally decentralized country by international comparison, as it is one of the countries in which subnational governments have the highest tax revenue to GDP ratios. The tax revenue share to total subnational government revenue is also relatively high, and grants’ share is relatively low, comparing to other countries. Therefore, Brazilian states have a greater level of own-source revenue than the international average.

Most of the intergovernmental fiscal transfers to subnational governments are made according to non-discretionary constitutional rules.

The Brazilian budget is known for its rigidity, which can be explained by the excess of earmarked revenues and the high volume of mandatory spending. Revenue earmarking is a mechanism provided by the Federal Constitution created for two main reasons: (1) to ensure that governments invest a minimum amount of the public budget in priority sectors, and (2) to avoid the free rider effect on constitutional attributions that are common to all three levels of government, such as health and education, that is, to prevent a level of government from not investing in one sector in the expectation that others will.

For the states, the most important earmarking between revenues and expenses are: (1) transfers to municipalities; (2) the minimum spending in health and education services of 12% and 25% of tax revenue, respectively (added to the states’ participation in Federal Government revenues and deducted from the tranches transferred to municipalities); (3) the revenues offered as collateral for payment of debts with the Federal Government or guaranteed by it; and (4) the resources of the states’ pensions system.

An overview of intergovernmental finance in Brazil was submitted to delegates for information and discussion at the 14th annual meeting of the OECD Network on Fiscal Relations across Levels of Government. The document introduces key issues related to fiscal relations in Brazil and discuss possible directions for reforms.

Access the entire paper from the OECD website: Ana Luisa Fernandes and Pricilla Santana. 2018. Reforms of Fiscal Relations in Brazil: Main issues, challenges, and reforms.