Land value capture, explained

What is “land value capture”? How does it work? And why have so many communities across the world applied this financial approach? Land value return is based on a simple core premise: public action should […]

What is “land value capture”? How does it work? And why have so many communities across the world applied this financial approach? Land value return is based on a simple core premise: public action should […]

The Outlook of Fiscal Relations between Levels of Government in Latin America and the Caribbean (Panorama de las relaciones fiscales entre niveles de gobierno en países de América Latina y el Caribe) is a joint […]

The Royal Government of Cambodia (RGC) has made a strong commitment to strengthening public service delivery through three interrelated public sector reform initiatives: Public Financial Management Reform Program (PFMRP), National Program for Public Administration Reform […]

Mismanagement of subnational finances can entail large economic and social costs, not only within theaffected jurisdiction, but also for a country as a whole. History offers many examples of costly bailouts of subnational governments by […]

Decentralization has been increasing in developing countries, oftentimes, with the encouragement of development partners. It is estimated that intergovernmental transfers account for about 60 per cent of total local government revenues in developing countries. Given this trend, the question […]

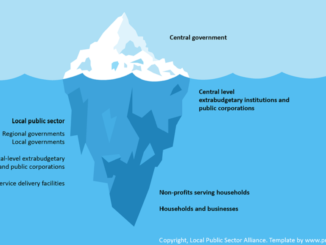

Global development does not take place within the walls of international development organizations. Nor does development take place within the walls of the central government ministries that are typically the main counterparts of international development […]

The management of public investments at the subnational level is an important part of public sector finance and subnational financial management for two reasons. First, the fiscal space that countries have available to allocate to […]

Fiscal decentralization can improve the quality of public spending if sub-national governments allocate their expenditures according to local needs and preferences. However, many other factors – especially those related to politics, influence allocative decisions. When […]

Fiscal federalism refers to the distribution of taxation and spending powers across levels of government, and is the focus of the OECD’s Network on Fiscal Relations across Levels of Government. Through decentralization, governments can bring public services […]

India is moving in the general direction of greater decentralization, with an emphasis on cooperative federalism across Union (federal), state and local levels. Passage of 73rd and 74th Constitutional Amendments in 1992 set the stage […]

Copyright 2015-2024. Local Public Sector Alliance.