2.1 Relevance of subnational expenditures

Many of the pro-poor public services that are required to achieve sustainable global development, including education, health services, access to clean water and sanitation, are delivered at the local level. In many countries, local public services and public sector investments in these areas are the responsibility of elected local and regional governments. In 2016, subnational government spending accounted for 24 percent of total public spending and close to nine percent of GDP on average (unweighted) for a global sample of 106 countries with available data (OECD/UCLG 2019:50).

Unfortunately, comparative figures are not available for the relative importance of other types of local public spending, such as deconcentrated spending,[7] delegated spending,[8] or direct central government spending on local services—spending through vertical sector programs. An analysis of education and health finance in 29 developing and transition countries reveals that countries typically rely on multiple models of decentralization at the same time, and that non-devolved expenditures accounts for approximately two-thirds of all local public sector expenditures on health and education (Boex and Edwards 2014).

2.2 An overview of devolved (local government) expenditure responsibilities

The subsidiarity principle. In many countries, the main principle behind the assignment of expenditure responsibilities is the subsidiarity principle. This principle suggests that—in order for the public sector to be as allocatively and technically efficient as possible—public sector functions should be performed by the lowest level of government that can perform the function efficiently. Conversely, functions should not be performed by a higher-level government if these functions can be dealt with effectively by a lower-level government. While the subsidiarity principle is widely regarded as best practice to be followed around the world, some countries have formally adopted it as a formal legal principle, because it was in the 1992 Maastricht Treaty that established the European Union.

The subsidiarity principle does not mean that all public functions should be performed at the local government level. In some cases, scale economies in the provision of public services may prevent a lower-level government from performing a function or task efficiently. In other cases, the territorial scale of provision would make it inefficient for a local government to perform certain functions. This occurs, for instance, when the benefits area of a service exceeds the territorial jurisdiction of the government responsible for provision. For instance, while a local park or playground that benefits a local community can be efficiently provided by a local government itself as the lowest government level capable of performing this function efficiently, it would be inefficient to assign the responsibility for national defense or the management of a specialized referral hospital to an individual local government unit.

Unbundling functions. An important concept related to the proper assignment of functions and expenditure responsibilities is the need to “unbundle” functions before applying the subsidiarity principle. Unbundling of broad sectoral functions or expenditure responsibilities (such as “health” or “education”) requires subdividing the function into smaller pieces along several dimensions: not only can the responsibility for a service delivery function be divided into various sub-functions and tasks or along the lines of economic inputs required to deliver the service, but it is important to consider the responsibility for a function in a granular manner along four different dimensions, namely (a) the responsibility for policy-setting, regulation, and oversight; (b) the responsibility for financing; (c) the responsibility for management and ensuring provision; and (d) the responsibility for actual (frontline) service provision, sometimes referred to as “production.”

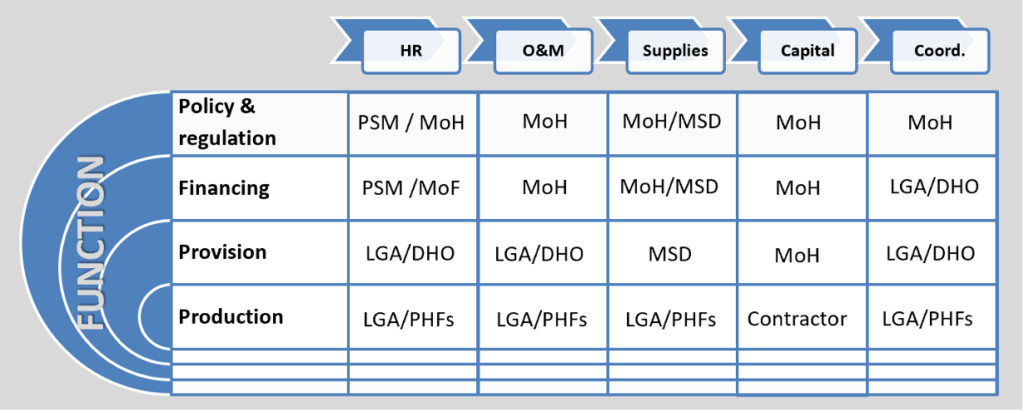

An example of an “unbundled” assignment of responsibility for basic public health services is presented below in Figure 2.1. The example reflects a decentralized system in which the responsibility for ensuring provision of basic public health services is assigned to local government authorities (LGA). Through the LGA’s District Health Office (DHO), basic health services are provided by local government-run public health facilities (PHFs), but – in this example – the Ministry of Health (MoH) plays an important role in setting sectoral policies and regulations. In addition, the ministry is extensively involved in the staffing of local DHOs and PHFs, with wage grant being provided by the central government, further provides conditional grants for operation and maintenance (O&M), and directly implements sectoral capital projects such as local health facility construction. Other central-level stakeholders assigned partial responsibilities over basic health services in this example include the Medical Stores Department (a parastatal entity), the Ministry of Finance (MoF), and the Public Service Management Department (PSM).

When the subsidiarity principle is applied to functions that are properly unbundled, three types of public services emerge: exclusively national (central or federal) government services, exclusively local government services and functions of concurrent (joint central-local) responsibility.

- Exclusively central government services—mainly national defense, international relations, certain macro-economic stabilization functions, and possibly specific social protection programs—are public services where the national government is the lowest-level government that can efficiently perform all aspects of functional responsibility: policy-setting and regulation; financing; provision; and production.

- Exclusively local government services such as local parks, streets and street lighting, and solid waste management, are public services where local governments are the lowest-level government that can efficiently perform all aspects of functional responsibility—policy-setting and regulation, financing, provision, and production. This is generally the case for basic local services which lack a strong redistributive dimension or (vertical or horizontal) externalities beyond the local jurisdiction.[9] To the extent that local governments are assigned the authority and responsibility to deliver exclusively local services, local governments are able to “manage local affairs” and function as an efficient platform for local decision-making and service delivery without much support from higher-level governments.

- In practice, however, many public services are concurrent (joint central-local) functions. This includes key social sector services such as education and health, as well as sectors such as agriculture and water and sanitation. Concurrent functions are functions for which local governments are the lowest government level that is able to take care of some aspects of the function—typically provision and production. In such cases, it would be inefficient to assign other aspects of the service – typically policy setting, regulation, and financing – to the local government level, and those would therefore have to be assigned to at a higher-level government. The effective delivery of concurrent functions or services requires careful coordination between different government levels, not only within the sectoral or administrative sphere, but across political and fiscal decision making as well.

2.3 An overview of non-devolved expenditure assignments

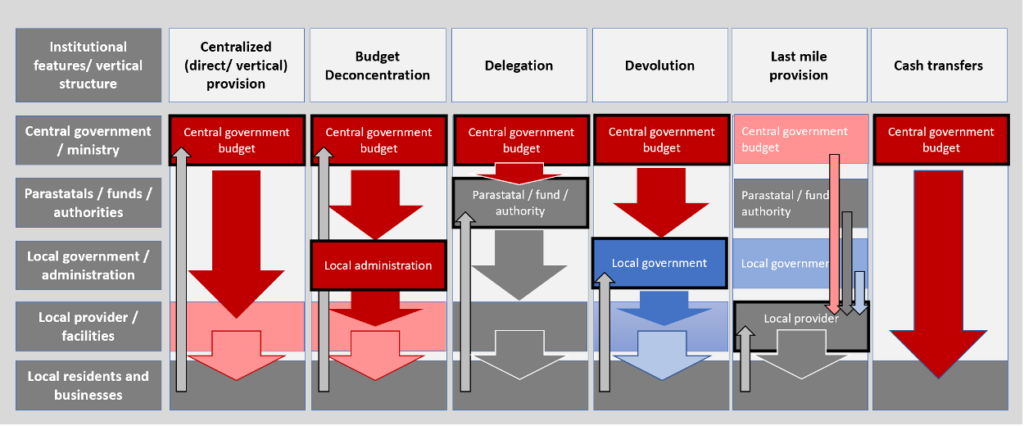

An incomplete picture of expenditure assignments may arise if one were to merely analyze central government expenditures and local government expenditure; in many countries and sectors, alternative (non-devolved) approaches to decentralization and localization are used (Figure 2.2).

Note: Red boxes and arrows indicate central government budgets and funding flows; blue boxes and arrows indicate local government budgets and funding flows; grey boxes and arrows reflect off-budget entity budgets and funding flows (or entities with indeterminate ownership).

In order to establish the extent to which stakeholders at each government level share the responsibility for service delivery in practice, mapping out the institutional trajectory and volume of the various funding flows—including different mechanisms used for different economic inputs or sub-systems within each sector—forms an important starting point for further policy analysis.[10] It is not unusual for local government finance specialists to be largely unaware of non-devolved sectoral funding flows, and sectoral experts are quite often more familiar with centralized funding flows within the sector than with any devolved funding mechanisms.

2.4 Common obstacles in expenditure assignments: technical challenges

Clarity in the assignment of service delivery responsibilities across levels of government facilitates better delivery of services and establishes clear accountability linkages. However, it is not unusual for countries or sectors (or development partners) to face an analytical challenge in answering the basic question: what the actual or de facto assignment of functions within a country or sector is as revealed by public sector expenditure patterns. This question requires assessing the volume and management of local government expenditures in a country by sector or function. Additionally, it requires considering service delivery expenditures made by central government through vertical programs or deconcentrated spending; national and regional parastatal entities, authorities and fund; and by local service delivery providers—for instance, from user fees or funding flows not already identified. The assessment of expenditure assignment also needs to take into account any limitations on the institutional powers or authority of local governments vis-à-vis the role of stakeholders at higher government levels. For example, while local governments are often assigned de jure responsibilities for basic urban services such as solid waste management, local water supply, or sanitation, even in urban areas, the role of local governments in improving public service delivery performance may be limited (Boex, Malik, Brookins and Edwards 2016).

As the first pillar of fiscal decentralization, problems with the assignment of functions and expenditure responsibilities tend to reverberate through the intergovernmental fiscal system. As discussed below, the biggest challenges with the assignment of expenditure responsibilities are not caused by technical or conceptual issues during policy design; instead, the main challenges are typically encountered during the policy implementation stage. Implementation obstacles include: (a) a gap between the de jure and the de facto assignment of functional responsibilities, as central ministries are often unwilling to let go of service delivery responsibilities; (b) weak vertical and horizontal intergovernmental sectoral coordination, including coordination challenges with parastatal entities and local-level (frontline) service delivery authorities; (c) the lack of “local political will,” or misaligned political incentives for local governments to effectively deliver services, especially concurrent services; (d) inadequate local government administrative capacity; and (e) underfunding of local expenditure responsibilities.

2.5 Political economy considerations: common obstacles in expenditure assignments

The assignment of functions and expenditure responsibilities is not only an important technical aspect of decentralization, but the expenditure assignment decision—both in terms of legal assignment as well as the decision on “who does what” in practice—is often shaped by political economy forces.

Empowering intergovernmental (fiscal) systems: expenditure assignments. In fact, there is a considerable gap in some countries—especially among developing and transition countries that are at the front end of their transition to a more decentralized system—between the assignment of functions and expenditure responsibilities that would be prescribed based on good technical guidance, versus the reality dictated by political economy forces. Rather than applying the subsidiarity principle and adhering to the mantra that “finance should follow function,” in accordance with good technical guidance, the political economy reality in many countries is that “functional assignments and finances follow political and institutional power”.

The vertical assignment of powers, functions, and expenditure responsibilities is often a contentious area of (fiscal) decentralization reform, with central (sector) ministries usually arguing that local governments are inadequately capacitated to perform sectoral key functions. Although local capacity issues are often a concern, it is not unusual for capacity constraints to be used by central-level officials as a (sometimes thinly veiled) excuse to prevent the sector ministry from yielding its power and resources to the local government level. Likewise, it is not uncommon for planning ministries or public service management agencies to be motivated by narrow institutional self-interest in their opposition to the decentralization of their powers, functions and resources to lower-level government entities.

In fact, in countries that have initiated decentralization reforms, a gap between the legal (de jure) functional powers and their de facto expenditure responsibilities—caused by the slow transfer of powers, functions and resources, is perhaps the most typically and biggest challenge to the successful decentralization reforms. Other political economy related problems arise in the assignment of expenditure responsibilities as well. For example, it is not unusual for a central government to (knowingly or accidentally) assign function responsibilities to a government level that, according to the subsidiarity principle, is too small or too weakly capacitated to efficiently deliver public services. In some cases, such expenditure assignment decisions are made in order to bypass regional elites or administrative opposition at higher levels, while in other cases higher level governments are avoided to minimize centrifugal forces or to limit local governments from being used as a platform for political competition.

Efficient, inclusive and responsive local governance: expenditure assignments. It is not just in the intergovernmental context that expenditure assignments and expenditure choices can be distorted by political economy forces; even when functions are assigned perfectly in accordance with the subsidiarity principle, it is quite likely that political considerations will come into play when local expenditure decisions are made. In fact, given that local governments are expected to set local spending priorities within a hard budget constraint, local government officials should be expected to make their expenditure choices not only on the basis of national policy commitment and technical considerations, but rather, on the basis of their constituents’ preferences and in line with spending priorities that are electorally or otherwise politically rewarding to them.[11]

In assessing local spending decisions, it is useful to keep in mind the duality of local governments. Local governments serve as platforms for local decisions-making and service delivery in areas of exclusively local interest, such as streetlights, local parks. They also serve as a platform that can be leveraged by higher government levels for national development objectives or for concurrent functions, for which the social benefit of service provision is often not fully captured or appreciated by either local residents or local politicians. But, under a devolved system, unless specific arrangements are in place to ensure otherwise, local leaders should be expected to over-spend on local projects with immediate benefits to the community, such as livelihoods projects or community-based infrastructure, while underspending (relative to national priorities) on social sector development and other concurrent functions.

Engaged civil society, citizens, and business community: expenditure assignments. Inclusion, participation, transparency, and accountability in guiding and monitoring public expenditures are widely understood to be important features of effective decentralization and good governance. These principles represent important underlying values for stakeholders at all levels, but political economy pressures, such as pressure from political party officials or electoral pressures, may cause elected officials to set aside these principles when they are under pressure to “get things done.” A similar type of political economy incentive—the desire to avoid negative scrutiny that comes with being the bearer of bad news—may act on local administrators, facility heads, and frontline workers when it comes to reporting on the performance of local expenditures. Mansuri and Rao (2013) argue that decentralized, participatory development is most effective when local institutions work within an “accountability sandwich” formed by support from an effective central state and bottom-up civic action.

| Box 2.1 Background and resources on the assignment of powers, functions and expenditure responsibilities – Municipal Finances: A Handbook for Local Governments (Catherine Farvacque-Vitkovic and Mihaly Kopanyi); World Bank, 2014. – Measuring the Local Public Sector: A Conceptual and Methodological Framework (Local Public Sector Country Profile Handbook); Local Public Sector Initiative, 2012. – Measuring Fiscal Decentralization, Concepts and Policies (Junghun Kim, Jorgen Lotz and Hansjörg Blöchliger); OECD Fiscal Federalism Studies, 2013. – Self-rule Index for Local Authorities; European Commission 2015. – The vertical assignment of functions and expenditure responsibilities (Jamie Boex); Local Public Sector Initiative, 2015. – Assigning responsibilities across levels of government: Trends, challenges and guidelines for policy-makers (Dorothée Allain-Dupré); OECD, 2018. – Revised Guidance for Subnational Government PEFA Assessments; PEFA, October 2020. |

[7] Deconcentrated spending refers to spending by deconcentrated offices of sector ministries in localities.

[8] Delegated spending includes spending mandate delegated by sector ministries to various governmental and quasi-governmental organizations including parastatal organizations, state owned enterprises, and utility companies.

[9] When a local public service has a strong redistributive dimension or produces (vertical or horizontal) externalities, it is likely that higher-level government ought to be involved in policy and standard-setting and/or financing in order to ensure an optimal level of public provision.

[10] As noted in Figure 2.3, it is not unusual for intergovernmental institutional and fiscal arrangements to differ for human resource expenditures (salaries and wages), operation and maintenance spending, sectoral supplies, and capital infrastructure spending. The governance or management—coordination; oversight; community engagement—associated with a public service could be considered a fifth input or sub-system.

[11] It is not unusual for central government hesitance to decentralize sectoral powers, functions and resources (and the resulting underfunding and weak local administrative capacity in areas of concurrent responsibility) to serve as a justification for local politicians not to take ownership over challenging sectoral functions while focusing on spending programs that are electoral “low-hanging fruit.”