Country Profile Background

While the federal system in Brazil traces its roots back to 1891, the evolution of the country’s intergovernmental system has been defined by an evolving struggle for power between the federation and the states. From 1930 through the 1980s, several rounds of military regimes alternately supported or weaken the country’s federal structures. The gradual resurgence of state interests in the 1970s culminated in a process of re-democratization, eventually leading to the adoption of the 1988 Constitution. This constitution contains detailed provisions about the political, administrative and fiscal organization of the federation, thus shaping Brazil’s current system of intergovernmental relations.

Organizational/Governance Structure of the Public Sector

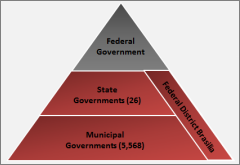

The Federative Republic of Brazil is composed of the Union, 26 States, one Federal District (Brasília) and approximately 5,700 Municipalities. Government units at all levels have their own elected political leadership and are considered autonomous in their own jurisdictions. The constitution provides for the possibility of the creation of new states and municipalities, subject to the approval of the concerned population (by means of a plebiscite) and upon the approval of the National Congress (or the state assemblies in the case of municipalities). In line with these provisions, around 1,500 new municipalities have been created since 1988. Unlike most other federations, the Brazilian constitution provides detailed rules for the management of the municipalities that are autonomous in their local affairs.

Functional Responsibilities of the Local Public Sector

Articles 20 through 25 of the Brazilian Constitution establish the division of powers and responsibilities between the different levels of the federation. The Union is assigned detailed and extensive powers in matters of national importance, including all functions traditionally reserved for national governments (such as national defense, international relations and regulation of trade). In addition, numerous functions are concurrently legislated by the Union, the states, and the Federal District. These powers include, among others, education, health, social assistance and environmental protection. As federal legislation overrides state and municipal legislative powers, there are few substantial opportunities for subnational governments to exercise concurrent legislation without federal consent.

Although considerable legislative authority rests with the Union and the States, municipalities are important providers of public services. In addition to being assigned the power to provide local services that are exclusively local in nature (such as public transportation), municipalities are assigned the power to provide primary education and health services with the technical and financial cooperation of the Union and the state.

Fiscal Profile of the Public Sector

As a result of the Fiscal Responsibility Law (introduced in 2000), there is a high degree of budgetary transparency at all government levels in Brazil. Over half (58.7%) of public sector expenditures in Brazil take place within the local public sector. Close to one quarter (23.0%) of total public expenditures take place at the municipal level, while 30.5% of public sector spending takes place at the State level. In addition to the expenditures made by subnational governments, 5.2% of total public expenditures are made by central government ministries for public services that are localized in nature. The national government retains 41.3% of public sector resources for national functions and activities that fall outside the local public sector.

The Constitution provides for a detailed assignment of revenue sources between the Union, States, and Municipalities. In addition to assigning one or more major revenue sources to each level, the sharing of revenues among the Union, the states and the municipalities is accomplished by the sharing of revenues from the three main federal taxes: personal income taxes (IRPF); corporate income taxes (IRPJ); and the selective value added tax (IPI). Additional revenue sharing mechanisms and earmarked transfer schemes are in place as well. As a result of these mechanisms, States collect roughly 20 % of their financial resources from intergovernmental transfers, whereas municipalities receive close to three-quarters of their funding as intergovernmental fiscal transfers from higher levels.

Institutional Profile of the Local Public Sector

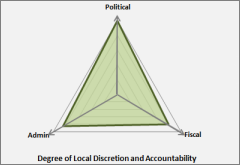

The political, administrative and fiscal autonomy of states and municipalities is defined and protected by the constitution. Although the concurrent assignment of various functional responsibilities requires considerable coordination and collaboration between the levels, each level nonetheless retains a relatively high degree of autonomy. All states (see graph) and municipal governments are led by their own elected leadership; each jurisdiction has substantial control over the administration and delivery of functions within its areas of responsibility; and has the fiscal instruments and budgetary powers necessary to respond to the needs of their constituents.

Country Profile Information

Complete LPS Country Profile: Brazil (PDF)

Complete LPS Country Profile: Brazil (XLS)