We live in a time of great economic, social and geopolitical uncertainty. Developing countries have been dealt a particularly bad hand and need to accelerate three transitions in this uncertain time, including—first, urban and rural transitions to creating sustainable spaces; second, green and social transition from unsustainable to clean and inclusive development; and, third, productive transition from low to high productivity levels with a circular economy and territorial approaches to development.

Advancing these three intertwined transitions demands a financial ecosystem that enables cities, local and regional governments to achieve the SDGs. To this end, the Malaga Global Coalition for Municipal Finance was created in 2018 by the United Nations Capital Development Fund (UNCDF) and United Cities and Local Governments (UCLG), in collaboration with its technical partner, the Global Fund for Cities Development (FMDV).

The Malaga Coalition policy agenda is proposed as a concrete path to developing the required financial ecosystem, which includes five building blocks: (1) intergovernmental fiscal transfers; (2) own-source revenues; (3) domestic capital markets; (4) city-friendly investment funds; and (5) guarantee funds for cities. These five elements aim to address cities’ and local governments’ financing gaps for the achievement of the SDGs, Paris Agreement, and New Urban Agenda.

Hosted by the Ayuntamiento de Malaga, the Third Malaga Conference took place on October 5-6, 2023, bringing together diverse actors, including mayors, government representatives, development banks, scholars, capital market authorities and commercial banks who are at the forefront of designing and implementing the five elements of the Malaga Coalition policy agenda.

After opening remarks by Hon. Mr. Francisco de la Torre (Mayor of Malaga), Ms. Emilia Saiz (Secretary General of UCLG) reminded the partners of the Malaga Coalition that the improvements of the financial ecosystem should focus on enhancing the ability of cities and local government to be partners in achieving global development objectives as encapsulated by the Sustainable Development Goals.

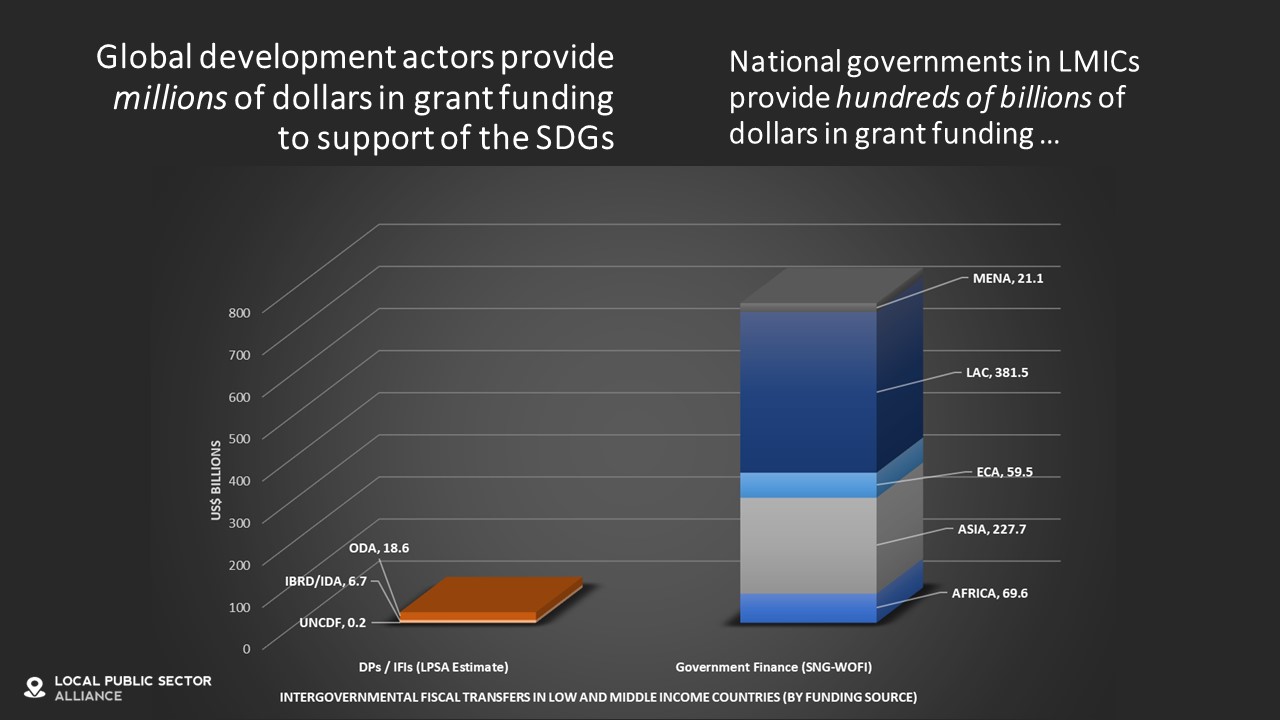

With regard to the role of intergovernmental fiscal transfers as development finance, Dr. Jamie Boex (Executive Director, Local Public Sector Alliance) highlighted three key takeaways:

- Intergovernmental fiscal transfers are the ‘work horse’ of intergovernmental finance systems and the main funding source for inclusive local services and sustainable development at the local level

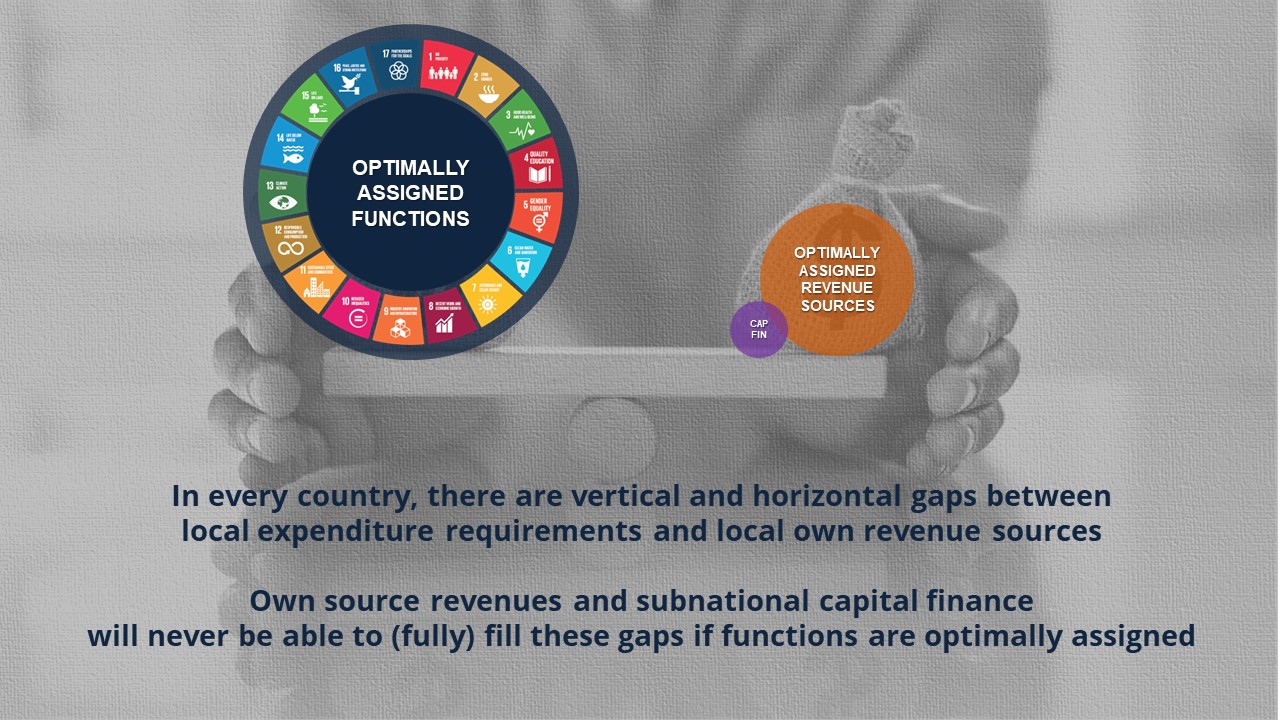

- Own source revenues and subnational capital finance are key mechanisms for funding localized development, but they are complements (not substitutes) for a good transfer system.

- More time and effort should be devoted to designing intergovernmental fiscal transfer systems that

are technically sound, politically acceptable, and achieve inclusive and sustainable development outcomes.

Dr. Boex further highlighted a number of challenges that tend to stand in the way of intergovernmental fiscal transfers being embraced as an instrument of development finance, including the misconception that local governments can or should fund themselves only or mostly from own revenues and borrowing. In addition, her highlighted the concern that local governments in many Global South countries are weakly empowered, as intergovernmental transfers can only unlock effective decentralized development when local governments are empowered and well-run (instead of being puppets of their respective higher-level governments).

Through dedicated roundtable discussions, the event further unpacked how the international financial environment and architecture can be reframed and better adapted for cities, local and regional governments and showcase concrete solutions illustrated by different high-impact cases.

During these discussions, Mr. Salim Bensmail (Senior Investment Director, Meridiam) stressed the need to recognize the important distinction between “funding” and “finance”, where adequate funding is needed to repay development finance. Mr. David Jackson (Director, Local Finance, UNCDF) emphasized the need to distinguish between the role of private funding and finance versus public funding and finance: while private goods can be purchased by households directly from the private sector, the optimal provision and production of public goods and public infrastructure—including those needed to achieve the Sustainable Development Goals—ultimately requires public sector funding.

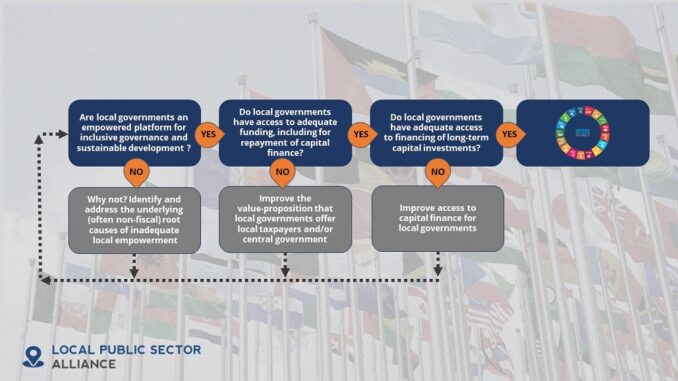

In his concluding remarks, Dr. Boex encouraged participants to not just consider the proximate causes of underdevelopment and inadequate subnational finance, but to identify and resolve their root causes. For instance, the absence of subnational financing may be a proximate cause of subnational under-investment—rather than a root cause—if subnational governments lack the necessary funding (from either own sources revenues or intergovernmental transfers) to secure and repay loans. In this case, the absence of the financing mechanism itself (or the absence of guarantees) would not be a binding constraint to development progress.

In turn, the lack of access to adequate local government funding is often not merely caused by the inadequate provision of intergovernmental fiscal transfers (typically, driven by the lack of central political will) or by technical failures in subnational revenue administration, but rather, by the weak empowerment of local governments (again, driven by political economy forces). Ineffective multilevel governance systems and weak local governance institutions tend to result in weak local accountability, poor value-for-money provided by local governments, and weak incentives for local revenue generation. In other words, inadequate local government funding is itself a symptom of the underlying problem, instead of the disease itself.

Rather than focusing on one single element of intergovernmental finance, resolving this vicious cycle of weak local governance and weak local government finance will require a more holistic approach to promoting inclusive governance and sustainable, localized development, which ought to focus on both fiscal as well as non-fiscal aspects of multilevel governance systems and local governance institutions.

This blog post was prepared by Jamie Boex. October 9, 2023.

Jamie Boex is the Executive Director of the Local Public Sector Alliance.