Mismanagement of subnational finances can entail large economic and social costs, not only within the

affected jurisdiction, but also for a country as a whole. History offers many examples of costly bailouts of subnational governments by the central government. Although subnational fiscal autonomy is an inherent part of devolution, it is nonetheless important for central government authorities to mitigate the macro-fiscal risk association with a devolved public sector.

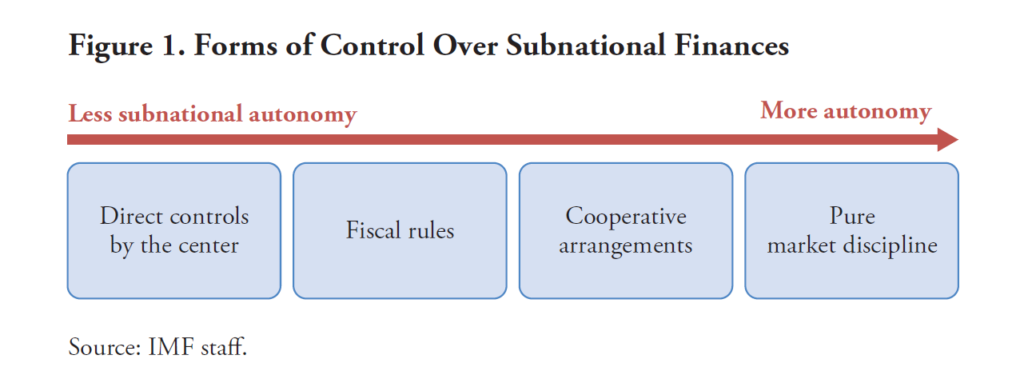

Subnational finances can be constrained in numerous ways. The various types of constraints can be classified according to the degree of fiscal autonomy left to subnational governments (Figure 1, below). On the left, direct controls by the central government are associated with the lowest degree of fiscal autonomy. For instance, the central government may set and revise each year’s ceilings on subnational debt or regulate the type of borrowing allowed. On the right, market discipline, where constraints are indirectly imposed by investors, provides the highest degree of autonomy; subnational governments are free to set their own targets, as long as their fiscal policy does not impair market confidence.

Fiscal rules are an intermediate form of constraint. They lie somewhat in the middle of the Figure 1 axis. Fiscal rules impose lasting constraints on fiscal policy. They are defined as fixed numerical limits (floors or ceilings) on fiscal variables set in legislation and binding for at least three years. Rules are not as prescriptive as direct controls but are more intrusive than market mechanisms.

In 2020, the IMF released a primer detailing how to design subnational fiscal rules, including how to select them and calibrate them. It expands on the guidance provided at the national level on rule selection and calibration in IMF (2018a) and IMF (2018b). Thinking on subnational fiscal rules is still evolving, including their effectiveness, and this note only provides a first analysis based on international experiences and the technical assistance provided by the IMF.

The note is divided into five sections. The first section defines fiscal rules. The second section discusses the rationale for subnational rules. The third section provides some guidance on how to select the appropriate rule(s) and whether they should differ across individual jurisdictions. The fourth section explores the issue of flexibility by looking at how rules should adjust to shocks. Finally, the last section focuses on the “calibration” of the rules.

Scope. Countries constrain the finances of subnational governments through a range of institutional arrangements. Fiscal rules are defined as constraints that are numerical, lasting, and apply to large fiscal aggregates such as budget balances and total expenditures. Fiscal rules are not as prescriptive as direct controls imposed by the national government, but they are more intrusive than market mechanisms.

Difficulties in designing subnational rules. Standard recommendations on rule design are difficult to transpose to subnational governments. For example, the model with a debt anchor and an operational rule advocated for national governments does not map well to the subnational level. Another challenge is that governments try to pursue two potentially conflicting objectives through subnational rules. On the one hand, subnational rules must be more binding than national rules to limit the scope for deficit bias (a tendency for governments to run high deficits) and excessive borrowing, which can be larger at the subnational level. On the other hand, subnational rules must leave enough flexibility to realize the benefits of decentralized decision-making tailored to local needs, especially given that subnational budgets tend to be more rigid (for example, providing for essential services).

Choice of the rule. There is no “perfect” subnational rule and its choice is necessarily context-dependent. A balanced-budget rule (that is, a rule barring a deficit) is usually not warranted because it prohibits borrowing for investment. Two other rules—the golden rule and the current balance rule—allow borrowing for this purpose. Between these two, a golden rule is inherently more restrictive. A third option is to combine a budget balance rule (imposing a nominal limit on the overall fiscal deficit) and a current expenditure ceiling, which may ensure better control over debt, while leaving space for investment.

Flexibility in response to the cycle. Cyclically adjusted balance rules are generally not warranted for subnational governments due to their complexities. Expenditure rules are a simpler way to address procyclicality concerns. However, the rigidity of subnational expenditures could make compliance difficult. Expenditure rules also impose no requirements on revenue collection, so excessive deficits remain possible. A better alternative to avoid procyclicality could be to combine a nominal budget balance rule with a rainy day fund.

Calibration of subnational rules. The calibration strategy needs to be adapted to the subnational context. It generally starts from (often ad hoc) constraints on borrowing and repayment, with the latter probably the most common approach. Intuitively, any limit on the ability to repay constrains the maximum amount of debt that can be incurred, because debt service is proportional to the amount of debt outstanding.

Download or read the full primer, How to Design Subnational Fiscal Rules : A Primer, by Luc Eyraud, Andrew Hodge, John Ralyea and Julien Reynaud on the IMF’s website.