The 2021 State of Cities Climate Finance Report examines the current state of urban climate investment, the barriers to reaching the needed investment levels, and the steps to overcoming these challenges. Produced by the Cities Climate Finance Leadership Alliance (the Alliance), the report contributes to the Alliance’s mission to mobilize city level climate finance at scale by 2030. The report also contributes to the Leadership for Urban Climate Investment framework initiative hosted by the Alliance, which aims to create a strong global architecture for subnational climate finance and tracking.

The report delivers its findings in two parts:

- The Landscape of Urban Climate Finance (Part 1). Authored by the Cities Climate Finance Leadership Alliance Secretariat (Climate Policy Initiative) in partnership with the Atlantic Council’s Adrienne Arsht-Rockefeller Foundation Resilience Center, Part 1 presents for the first time a comprehensive estimate of global urban climate finance. The Landscape was developed by tracking all sources of climate finance flows to urban areas and estimating urban climate investments in the buildings and transport sectors. Part 1 also presents some of the Alliance’s activities to address barriers to investment.

- The Enabling Conditions for Urban Climate Finance (Part 2). Authored by the World Bank, Part 2 analyzes enabling frameworks and presents solutions for mobilizing climate finance for low-carbon, climate-resilient urban development pathways. It seeks to provide a common level of understanding of the terminologies, knowledge, and themes used by climate policy and climate finance practitioners, city-level urban planners, and municipal finance officials.

The Executive Summary summarizes the key findings from both Parts, including the current context for city-level climate action, estimated urban climate finance flows, the enabling conditions needed to mobilize more finance, and steps to address the urban climate investment gap.

Context

Cities must be at the forefront of global efforts to reduce greenhouse gas emissions and climate change risks. Cities already account for 70% of global CO2 emissions from energy use; left unaddressed, emissions will continue to rise as urbanization accelerates, especially in developing countries. Cities are also at the forefront of climate change vulnerability: 70% of cities are already experiencing harmful impacts to their citizens and infrastructure as a result of climate change.

Greenhouse gas emissions in cities can be reduced by almost 90% by 2050 with technically feasible, widely available measures, potentially supporting 87 million jobs in 2030 and generating a global economic dividend of USD 24 trillion (Coalition for Urban Transitions 2019). The International Finance Corporation (IFC) estimates that urban sustainable investment opportunities in six sectors (waste, water, renewable energy, electric vehicles, public transport, green buildings) in emerging markets alone amount to USD 2.5 trillion annually through 2030 (IFC 2018).

Moreover, cities are motivated to act. To date, 6,150 cities participating in the Global Covenant of Mayors and representing 20% of urban residents globally have developed climate action plans. National governments, cities, and public and private financial institutions are also increasingly acknowledging the importance of cities to climate action and launching initiatives to address barriers to accessing finance.

Despite this momentum, cities continue to face significant headwinds in mobilizing finance for transformational climate action. Many of the barriers to finance identified in this report’s predecessor, The State of City Climate Finance 2015, remain in place, including the lack of technical and financial capacity, control over resources, and workable funding models. These barriers are especially prevalent in developing economies.

The COVID-19 pandemic added further financing strain to cities, and the disruption continues to make planning for the future difficult. While cities are spending more on social protection to address the health crisis, many cities have lost local revenue sources due to the accompanying economic crisis. This decline in revenue further constrains the ability of cities to provide essential infrastructure and services, such as mobility, sanitation, and housing.

COVID-19 recovery efforts run the risk of locking in high greenhouse emissions and human vulnerability pathways. Today, due to the pandemic, cities are either relying more on intergovernmental fiscal transfers, especially stimulus spending, or they are at risk of making cuts and facing difficult choices and tradeoffs, including forestalling climate change action. This is especially the case in rapidly urbanizing cities in Africa and South Asia. In these cities, there is a real risk of high greenhouse emissions and human vulnerability pathways becoming “locked in” if long-term development and climate considerations are not integrated into recovery efforts from the start.

The ability of cities to meet their climate action ambitions is therefore at a critical juncture, and requires partnership with national governments, international organizations, civil society, and the private sector.

Urban Climate Finance Flows

Part 1 presents the first comprehensive framework for tracking urban climate finance. It comprises key definitions and a taxonomy of urban mitigation and adaptation activities. Applying this framework, the estimates for urban climate finance are then based on project-level data tracked in Climate Policy Initiative’s Global Landscape of Climate Finance report (CPI 2020), and then further complemented by an exploratory approach to estimate sector level capital expenditure using sector installed capacity data and investment cost data, currently for green transport and buildings activities only. Both methods have the potential to be expanded and refined. The data presented in this Executive Summary aggregates tracked and estimated data while the full report provides additional insights into data derived from each approach.

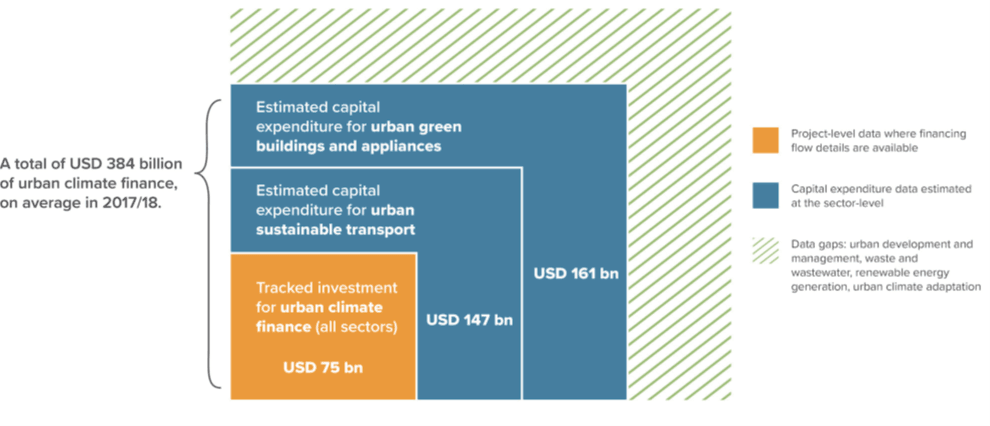

Climate finance flows for cities reached an estimated USD 384 billion annually on average in 2017/2018, far short of urban climate finance needs (Figure 1). Of the USD 384 billion, USD 75 billion is tracked using bottom-up, project-level information, USD 147 billion is estimated from expenditures in urban green transport, and USD 161 billion is estimated from expenditures in urban green buildings and appliances. The analysis used in this report defines “urban climate finance” to include all sources of finance flowing within cities and channelled by all types of public and private actors towards climate mitigation and adaptation.

Despite uncertainties inherent in this type of analysis, urban climate finance flows are far less than needs, estimated to stand at USD 4.5 to 5.4 trillion annually (Alliance 2015).

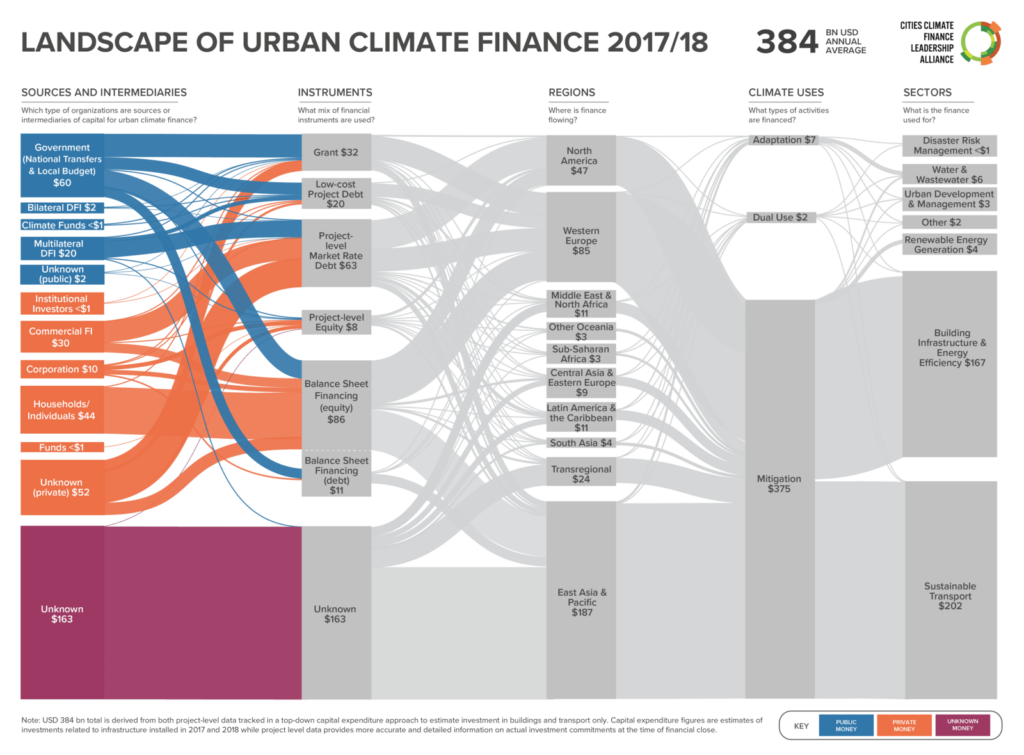

Private finance, and in particular household expenditures, plays a big role in urban climate finance (figure 2). Annual private finance estimates averaged USD 136 billion in 2017/2018, corresponding to 35% of total urban climate finance, mainly driven by domestic actors. Household expenditures, which accounted for more than 30% of private urban climate finance tracked, were used primarily for the purchase of private electric vehicles and energy efficiency improvements in residential buildings. Public sector investment averaged USD 84 billion annually in 2017/2018, comprising 22% of total urban climate finance. The largest contributors were national and local governments. A significant portion of national and local governmental funds, approximately USD 60 billion, were invested in sustainable transport and energy efficiency in buildings. Reflecting the current difficulty in tracking urban climate finance, the remaining 45% of urban climate finance, or approximately USD 163 billion, originated from unknown sources.

Vastly insufficient levels of urban climate finance were invested in developing economies, such as South Asia and Sub-Saharan Africa, which saw an annual average investment of just USD 4 billion and USD 3 billion, respectively.

Urban climate finance flows are heavily concentrated in OECD countries and China. Cities in developing countries (excluding China) only saw minor volumes of climate investment despite their rapidly growing urban centers. The majority of urban climate finance was invested in Western Europe (averaging USD 85 billion annually), North America (USD 47 billion annually), and East Asia and Pacific (USD 187 billion annually). East Asia investment was driven largely by investments in China in sectors such as waste and wastewater management and sustainable transport. Almost all of the estimated financing for electric buses globally took place in China. Vastly insufficient levels of urban climate finance were invested in developing economies, such as South Asia and Sub-Saharan Africa, which saw an annual average investment of just USD 4 billion and USD 3 billion, respectively.

The estimated flows of urban mitigation finance (to reduce or avoid greenhouse gas emissions) far outweigh those of urban adaptation finance (to respond to climate related risks), though data availability is also uneven. Investment for urban climate change mitigation activities averaged USD 375 billion during 2017/2018. Of that, the annual estimated investment for urban, low-carbon transport averaged USD 202 billion or 53% of total urban climate finance. The urban buildings sector attracted an estimated average of USD 167 billion or 44% of total urban climate finance. The estimated annual investment in urban adaptation and resilience measures were primarily in water and wastewater projects and averaged USD 7 billion, representing 9% of tracked project level data (the capital expenditure approach was not applied for adaptation). This 9% share of climate finance for adaptation is consistent with shares seen in estimates of total global climate finance (CPI 2020).

Although data are not yet available, an increase in urban climate finance can be anticipated for 2019, but investment trends for 2020 and beyond are highly uncertain due to the COVID-19 pandemic. In this uncertain environment, positive and negative factors are at play. On the positive side, development banks have increased their climate commitments, some countries have adopted green recovery packages, and consumer investment in electric vehicles has continued on an upward trend. On the negative side, many cities are delaying or reducing non-essential capital expenditures, and, at the national government levels, spending on electric vehicle subsidies has decreased (IEA 2021).

Enabling Conditions

Enabling conditions play a crucial role in determining whether and where climate investment can be mobilized in urban areas, irrespective of the source of financing.

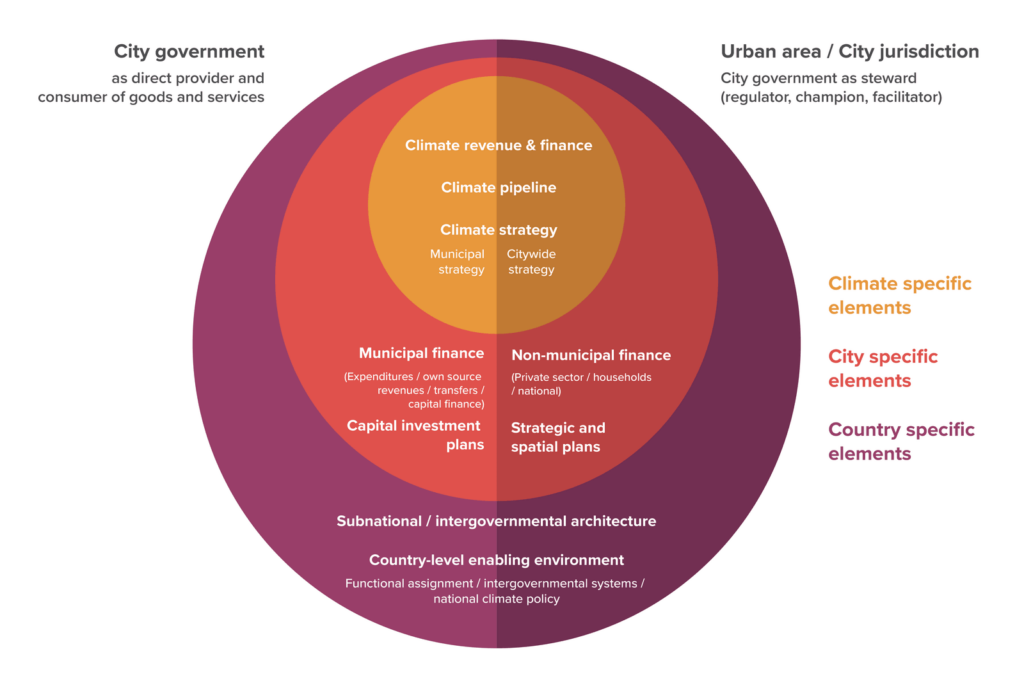

There are three main enabling elements that influence urban climate finance outcomes:

- Country-specific – national-level governance and fiscal systems under which cities fall and which determine what they can do in terms of planning, regulation, and finance;

- City-specific – the capacity and remit cities have for planning and financing expenditures and their potential for mobilizing or attracting other sources of finance; and

- Climate-specific – connecting city-level climate investments with the appropriate climate financing instruments.

City governments play multiple roles. They can impact climate outcomes by leveraging their roles both as providers of infrastructure and services (what cities pay for) and as stewards with their capacity to plan, regulate, convene, and champion (what cities influence). How cities purchase goods and services, provide municipal services, raise financing, regulate private sector activities, and build coalitions of stakeholders can influence their developmental trajectories significantly. In particular, the ability of city governments to convene stakeholders while aligning optimal urban planning practices, appropriate regulations, and targeted incentives can have systemic impact. These actions can help cities harness private sector and household investment in climate-action that may greatly exceed their current capacity to mobilize local public funds.

Cities operate in a wide spectrum of enabling environments across countries. Therefore, each city’s context must determine the relevant policy levers and financial tools for mobilizing urban climate finance. In countries with weak intergovernmental and fiscal systems, cities often have low capacity and autonomy to regulate their built environment, raise own source revenues, plan investments, and manage their municipal finances. At the other end of the spectrum, when countries have stronger intergovernmental and fiscal systems and allow greater autonomy and capacity for city governments, cities are able to mobilize a wider array of finance sources for climate investments.

Despite wide differences in enabling environments within countries and across the world, cities are leveraging their roles as providers and stewards to mobilize investment to reduce GHG emissions, enhance climate resilience and improve the quality of urban life.

Cities as providers

Procurement and consumption. Adopting green procurement standards is a growing trend that makes a significant impact by leveraging local governmental purchasing power for achieving sustainability goals. Many cities in the European Union and North America, as well as Santiago, Chile and Cape Town, South Africa, are adopting such standards. This signals a market demand for energy efficient vehicles, lighting, equipment, and buildings, while also reducing both the upfront costs through the potential for bulk procurement as well as longer term costs for operations, maintenance, and replacement.

Service provision. Apart from consumption, cities are also greening the services they provide. For example, Helsinki, Finland set a target of carbon neutrality by 2035 and created a detailed action plan to reduce GHG emissions for district heating, electricity generation, and public transport.

Fundraising. Under appropriate conditions, cities can mobilize additional sources of finance by imposing impact or betterment fees. For example, Miami, USA, imposes impact fees on real estate development to help fund coastline improvements that will reduce the damage of sea-level rise; Ghaziabad, India, issued a green bond for a water treatment facility.

Cities as Stewards

Standards and regulations. Through the enforcement of new standards and regulations, city governments can ensure that private development aligns with their climate goals. This includes, for example, the use of innovative storm water credit programs to balance the demand for new construction with needed environmental protection and climate change mitigation measures as is done in Washington, DC and Philadelphia, USA.

Convening and systems-level planning. Cities are also working together to raise awareness and push for climate action across and between actors and systems (e.g., energy, transport, land, waste, health, etc.) and at higher levels of government. An example of this is the C40 Cities Climate Leadership Group, which includes Accra, Dhaka, London, Bogotá and Jakarta, among other cities. The leadership group convenes member cities for knowledge sharing, peer-to-peer exchange, and policy advocacy to national governments to act on climate change.

Addressing the investment gaps: recommendations

This section offers recommendations for city, national, and international officials to achieve transformative, well-planned, and well-financed climate action in cities and urban systems. These interventions must be tailored to address country-specific, city specific, and climate-specific enabling elements.

At the city level in their roles as providers, municipal officials should:

- Strengthen their city’s municipal finance capacities, including budgeting, financial management, contract management, and procurement, to improve the overall quality of service provision and investments. They can also lay a stronger foundation for climate finance through the improved use of fiscal transfers, own-source revenues, and blended finance instruments.

- Enhance capital investment planning by integrating carbon pricing and other climate-smart metrics into decision making. This sends an important signal to private sector actors operating in the city space and helps position the city to address the regulatory risk of national carbon pricing requirements.

- Where possible, cities should leverage municipal own source revenue as a tool to create fiscal space for city climate investments and as an instrument to incentivize residents, business, and other stakeholders to invest in more resource-efficient and climate-smart outcomes.

- Where possible, climate-smart urban infrastructure projects should be prepared with attention to potential revenue generation opportunities and with private sector engagement from an early stage.

At the city level in their roles as stewards, municipal officials should:

- Define and embed climate considerations in all four levels of city planning (strategic, spatial, capital investment, and budgetary) and ensure alignment among these four levels.

- Adopt and implement regulations, design standards, and incentives to encourage private and household investment in green buildings, vehicles, equipment, and appliances.

- Assess and communicate how city climate action plans align with national and international goals like the Paris Agreement [and respective Nationally Determined Contributions (NDCs)] and the Sustainable Development Goals (SDGs). If the plans are not yet aligned, cities can compare local plans with national targets and align them accordingly – or be even more ambitious. This alignment could attract public and private investments, especially when concrete investment strategies and plans for urban climate-smart infrastructure are established.

For cities that operate under more central administrative systems, where their capacity to raise revenue or debt may be limited, it is recommended that officials focus on leveraging their roles as providers and as facilitators, conveners, and advocates of urban climate action.

Cities will need the support of their national governments to fulfil their climate ambitions. Therefore, at the country level, national governments should:

- Support national and city-level climate policy alignment both top down and bottom up. For example, national governments should incorporate and incentivize the efforts of cities when developing and updating their NDCs and National Adaptation Plans as well as during their implementation.

- Strengthen national level standards, regulations, and data systems that support low carbon and climate-resilient urban planning and development and carbon pricing mechanisms at the municipal level.

- Adapt and leverage intergovernmental and fiscal transfer systems to support and incentivize city-level climate action.

- Direct green recovery stimulus funds to urban areas which have borne the brunt of COVID-19 cases and face continued economic uncertainty. Also direct green stimulus funds to areas that are urbanizing rapidly in an unmanaged way and at risk of locking in carbon intensive and climate vulnerable pathways, especially in developing economies.

Given the especially low levels of urban climate investment flowing to most developing countries, support is also needed at the global level. Climate finance and policy practitioners in international organizations and public finance institutions, including subnational, national, and international development banks, should:

- Support cities to embed climate considerations in all four levels of local planning (strategic, spatial, capital investment, and budgetary) and ensure alignment among these four levels.

- Support cities to strengthen their municipal finance fundamentals, including budgeting, financial management, contract management, and procurement.

- Help cities lay the foundation for climate finance through the improved use of fiscal transfers, own-source revenues, and blended finance instruments.

- Convene and strengthen the capacity of different levels of government to mobilize urban climate investment from intergovernmental fiscal transfers and private markets and households.

- Help coordinate, align, and mainstream climate change considerations in cities and urban systems at all levels through policies, planning, intergovernmental processes, and finance.

- Support the early, and often delicate, project preparation phase as part of the financing process. This could include providing dedicated technical assistance

facilities and encouraging public-private partnerships where institutional frameworks are sufficiently robust. - Help cities and project developers identify local finance sources and innovative financing models, such as aggregation approaches and leasing models, including to allow small and medium-sized projects and clean technologies to be implemented.

- Use catalytic funding and innovative finance mechanisms, such as blended concessional finance and partial guarantees, to de-risk private investment and

expand insurance. This can help address the increasing climate-induced risks faced by cities, especially in developing economy cities that are unable to access capital markets.

Finally, there is a clear need to improve urban climate finance tracking and data availability. Better data and tracking are a powerful policy and investment prioritization tool for national and subnational policymakers, international organizations, and impact oriented investors. Among the main priorities for improving urban climate finance tracking going forward:

- Donors, development finance institutions, local governments, and cities should increase efforts to monitor and report climate finance projects that benefit urban dwellers. Tracking investments at the project level provides valuable information to support progress monitoring, measure gaps, identify synergies, and optimize and identify opportunities surrounding the urban green transition. Local governments in particular could benefit from using climate budget tagging to measure progress and inform efforts to better coordinate and mobilize climate finance. These efforts could also go beyond city budgets to track the contributions being made by all major public and private actors.

- Development finance institutions can promote best practices to track and report urban climate finance at the project level by developing harmonized definitions, taxonomies, and methods. This could highlight approaches that other investor groups could adopt.

- Private financial institutions and corporations should consider reporting standardized data on their climate-aligned urban investments to a central repository, such as CDP.

Conclusion

To address climate change, there is an urgent need to finance and support climate action in cities and urban systems. This report has demonstrated that there is substantial investment, estimated at USD 384 billion annually on average, flowing to cities for climate action. However, this sum falls far short of investment needs, which are estimated in the trillions. Most importantly, this sum disguises the highly insufficient levels of climate investment in developing country cities where urban growth will be the fastest.

Current urban climate finance flows and enabling conditions to mobilize greater levels of urban climate finance need to be better understood, measured, and tracked so as to inform how nations and cities can best:

- Green and align vertically the existing urban finance systems and intergovernmental architectures at the local and national level (increase the green share);

- Mobilize new urban climate finance at the city level, including through conditional intergovernmental transfers, own source revenues, and private markets and urban households (increase the pie); and

- Increase the climate-smart impact by strengthening urban and capital investment planning systems with green regulations and design standards, promoting compact spatial form, and integrating dynamic GHG measurement and pricing carbon into investment planning decisions (increase the impact).

To achieve the goals of the Paris Agreement and the Sustainable Development Goals, cities need to take action but, most importantly, so do their partners. National governments; subnational, national, and international public finance institutions; civil society; and the private sector all have critical roles to play in mobilizing urban climate finance. These actors need to come together and step-up collaboration to create the enabling conditions to mobilize urban climate finance at scale as well as develop creative, workable solutions that are tailored to each city context –such as impact fees, fiscal transfers, blended finance instruments or other tools. Cities and urban systems must be at the forefront of global efforts to reduce the emissions and risks associated with climate change. To mobilize urban climate finance at scale and in time to address the climate change crisis, the State of Cities Climate Finance report 2021 calls for a systems level and whole of economy approach, whereby country, city and climate policies, data and activities are aligned, well-funded and executed at the local level.

Access the original post and the full report on the website of the Cities Climate Finance Leadership Alliance: